Start Your IRS Relief Application

Begin your official IRS relief process now—guided by automated systems every step of the way. Tax experts available when you need support.

See How It Works

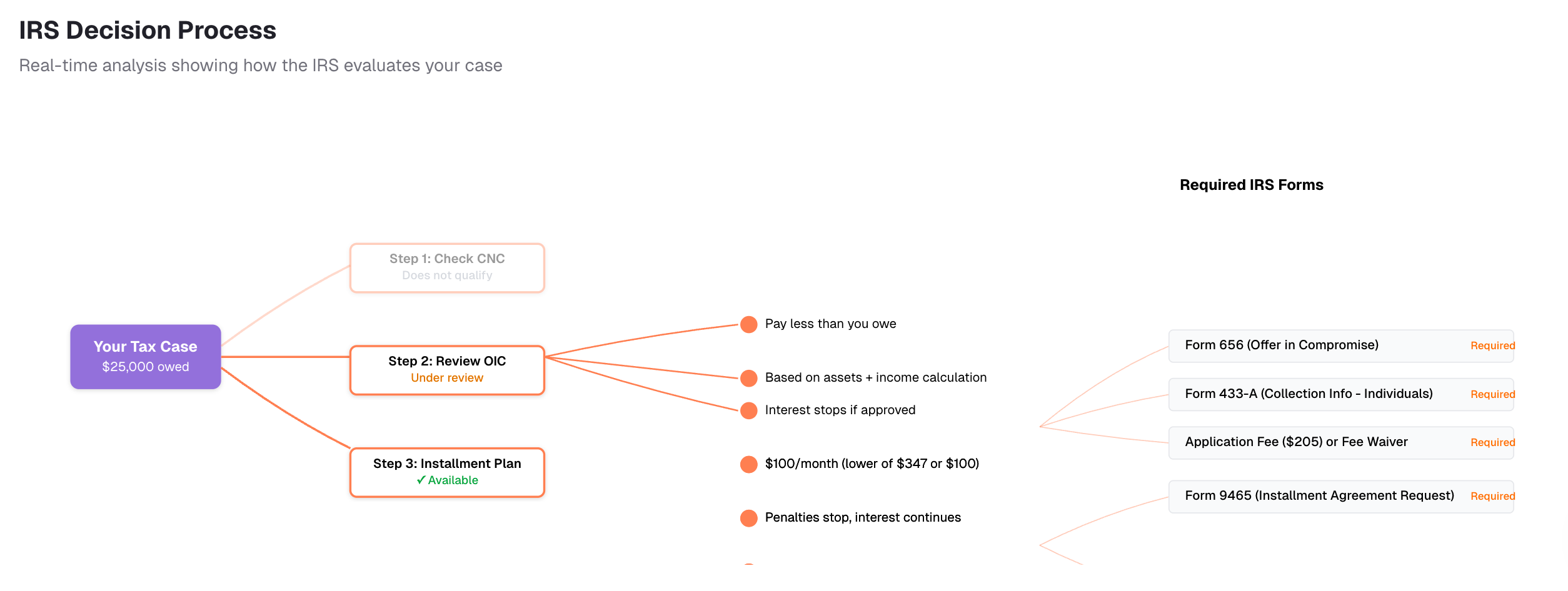

Real-time analysis showing how the IRS evaluates your case

Enter Your Tax Debt

Tell us how much you owe to get started

We Prepare Your Forms

Your IRS paperwork filled out automatically

Get Tax Relief

Approved and ready to resolve your debt

The Tax Debt Crisis

on Payments

Tax Debt

Per Taxpayer

Traditional Relief

Instant Analysis

See which IRS programs you qualify for in real-time as you enter your financial information

IRS Decision Tree

Visualize exactly how the IRS evaluates your case through their decision-making process

Required Forms

Get the exact IRS forms you'll need to complete your application for relief programs

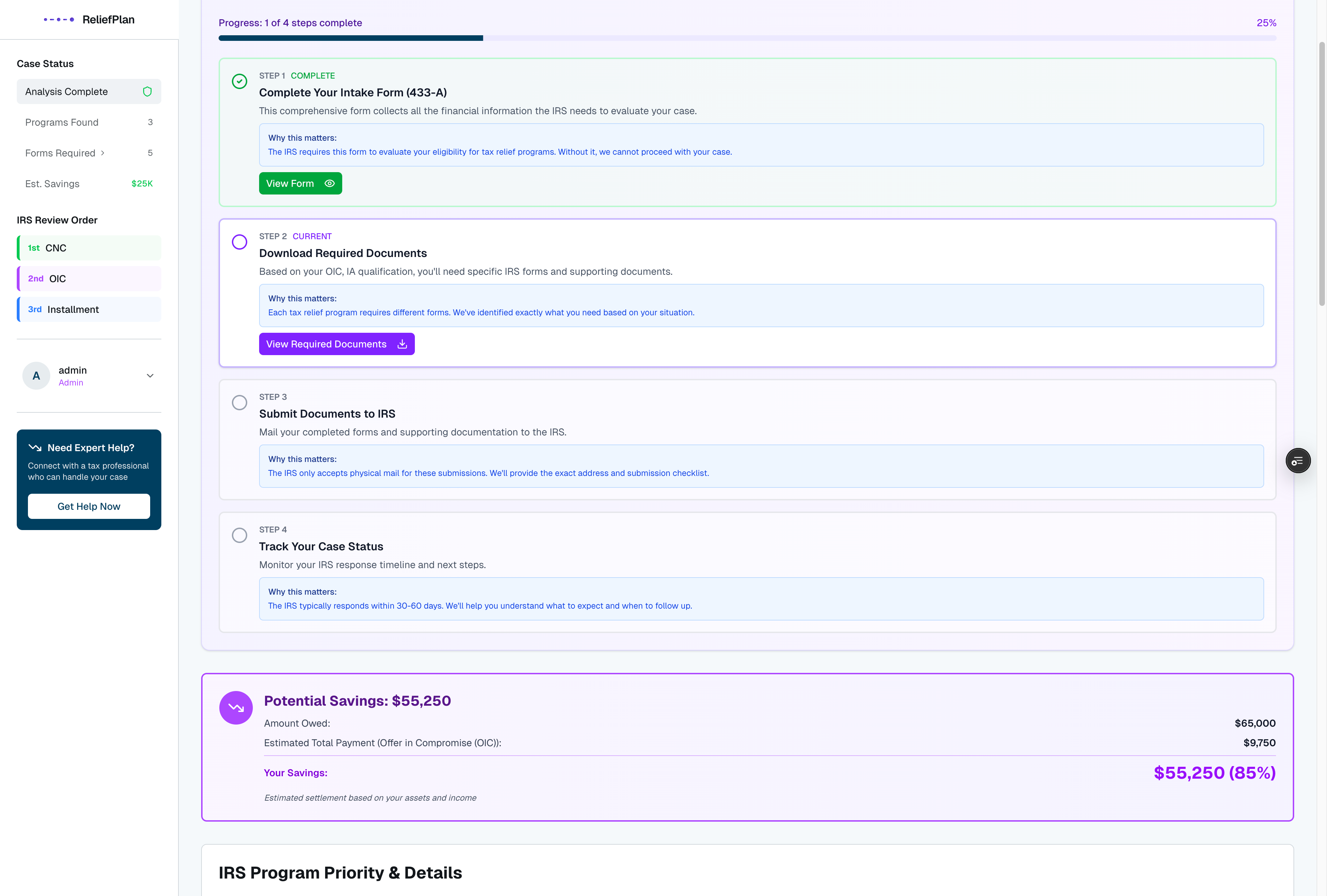

Your Complete Roadmap to IRS Relief

Everything you need to resolve your tax debt, step by step

Save thousands on IRS tax relief—guaranteed

The IRS evaluates over 10 million cases every year, and 40% of taxpayers qualify for relief programs they don't know about. We show you exactly which programs match your situation.

Most tax relief firms charge $6,500 or more for the same IRS programs you can access yourself. With FreshRelief, you get expert guidance for just $29/month—that's over $6,000 back in your pocket.

You can start your relief application for free—no credit card required. Our instant analysis shows you which programs you qualify for at no cost. If you choose to proceed with submitting your application, we offer transparent pricing starting at $29/month. This is significantly less than traditional tax relief companies that charge thousands upfront.

Frequently Asked Questions

Quick answers to common IRS tax relief questions

How do I find out if I owe the IRS?

You can check your IRS balance by starting our free online application above. Enter your tax debt amount and we'll help you understand your situation and identify relief options. Our automated system guides you through the process without requiring you to contact the IRS directly or navigate complex IRS forms.

How do I pay the IRS if I can't afford the full amount?

If you can't pay your full tax bill, you may qualify for an IRS payment plan or hardship program. Start our application to see which relief options match your financial situation—including installment agreements, partial payment plans, or offers in compromise. Our system analyzes your income and expenses to show you what you qualify for.

How do I get a fresh start with the IRS?

The IRS Fresh Start program includes several relief options like Currently Not Collectible status, Offer in Compromise, and streamlined payment plans. Begin your application above to see which Fresh Start programs you qualify for based on your financial situation. We'll guide you through the qualification process and show you potential savings in real-time.

How do I stop IRS letters, calls, and collection notices?

IRS collection actions can be stopped by entering an approved relief program or payment plan. Start your relief application to identify which program you qualify for. Once you're enrolled in a relief program, IRS collection activities typically pause. Our automated system helps you complete the necessary steps to request relief and stop ongoing collection actions.

How long does the IRS relief application process take?

With our automated system, you can complete your relief application in as little as 15-30 minutes. Traditional relief services can take weeks or months, but our platform instantly analyzes your information and shows you which programs you qualify for. Most applications are processed and submitted within days, not months.

Do I need a tax attorney or professional to apply for IRS relief?

No, you can complete the entire IRS relief application process online without speaking to anyone. Our automated system guides you through each step and shows you which programs you qualify for. Tax professionals are available if you need support, but most users complete the process independently using our step-by-step guidance.

What IRS relief programs am I eligible for?

IRS relief programs include Currently Not Collectible (CNC), Offer in Compromise (OIC), and various payment plans. Start your application above to see your personalized program matches based on your income, expenses, and assets. Our system uses the same criteria the IRS uses to determine eligibility, so you'll know exactly which options are available to you.

How much does it cost to apply for IRS tax relief?

You can start your relief application for free—no credit card required. Our instant analysis shows you which programs you qualify for at no cost. If you choose to proceed with submitting your application, we offer transparent pricing starting at $29/month. This is significantly less than traditional tax relief companies that charge thousands upfront.